Trick wrote:Bezos of Amazon is an "lover of humanity" an philanthropist, isnt that more than enough

windwalker wrote:Yep some are definitely not enjoying

the tax cuts.

"State financial experts on Tuesday reported fiscal year-to-date revenues are more than $2.3 billion below the expectations set by Newsom’s first spending plan.”

The reason, they believe, is that wealthy taxpayers delayed paying their taxes. Because they are no longer able to claim more than $10,000 under the SALT deduction, it made more financial sense for California’s rich to hold onto their money and earn interest until the April 15 filing deadline rather than paying the tax during 2018, as usual."

yeniseri wrote:windwalker wrote:Yep some are definitely not enjoying

the tax cuts.

"State financial experts on Tuesday reported fiscal year-to-date revenues are more than $2.3 billion below the expectations set by Newsom’s first spending plan.”

The reason, they believe, is that wealthy taxpayers delayed paying their taxes. Because they are no longer able to claim more than $10,000 under the SALT deduction, it made more financial sense for California’s rich to hold onto their money and earn interest until the April 15 filing deadline rather than paying the tax during 2018, as usual."

It makes objective sense and is logical. If corporations end up paying no taxes then less taxes in the coffers meaning no revenue for any type of infrastructure.

It seems that the people making minimum wages are those paying more and said workers combined can never make up for even the largest single corporation.

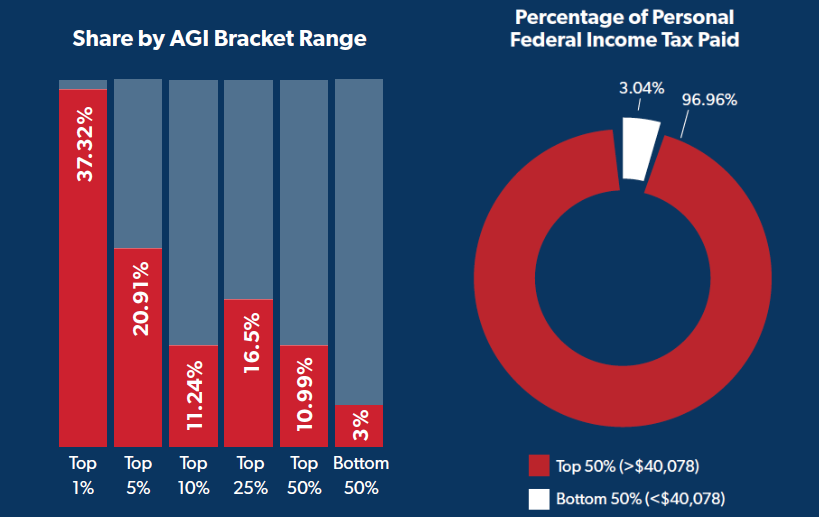

The trends are clear: the code has become increasingly progressive, and when people are allowed to keep more of their own money, they prosper, move up the economic ladder, and pay a bigger part of the income tax bill for those who aren’t."

For example, GM is paying zilch and claiming a $104 million refund on $11.8 billion of profits. Amazon is paying no taxes and claiming a $129 million refund on profits of $11.2 billion. (This is after New York offered it $3 billion to put its second headquarters there.)

The list of no-longer deductible items was fairly long:

Union dues;

Tools and supplies used for work;

Work clothes and uniforms, if required and not suitable for everyday use;

Work-related travel, transportation and meal expenses;

Depreciation on a computer or mobile phone that your employer requires you to use in your work;

Work-related education;

Home office expenses for part of your home used regularly and exclusively in your work;

Expenses of looking for a new job in your present occupation, including travel;

Legal fees related to work;

Subscriptions to trade journals or magazines;

Business liability insurance premiums; and

Dues to professional societies.

Users browsing this forum: No registered users and 21 guests